Answers To Current Account Queries

A current account supports frequent business transactions, fund management, automated payouts, and operational tracking. It is designed for companies needing higher activity flexibility than personal banking accounts across daily workflows and growing operations.

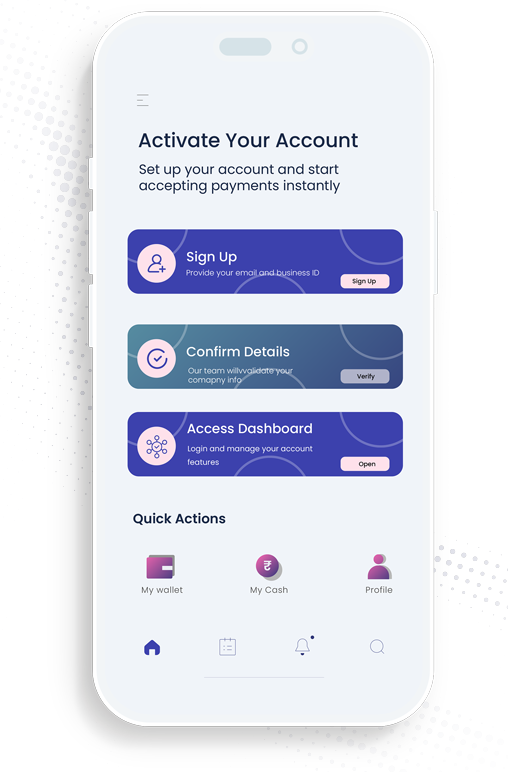

Businesses with valid registration documents can apply online by providing required details, completing verification, and gaining dashboard access after approval, ensuring readiness for operational fund management and internal payment workflows.

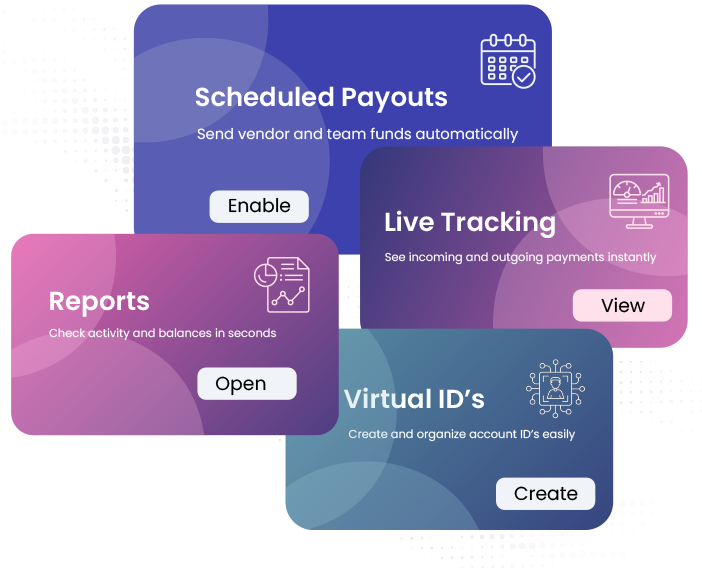

The account enables receiving funds, managing balances, scheduling payouts, tracking inflows and outflows, and organizing approvals from one interface, simplifying daily financial operations across teams, departments, vendors, and partners.

Charges depend on selected services, transaction volumes, and usage patterns. Transparent details are shared during onboarding to help businesses plan costs without hidden conditions or unexpected deductions over time.

The account is designed to support evolving operational needs, allowing businesses to scale transaction volumes, manage payouts efficiently, and maintain structured financial oversight as teams, operations, and payment requirements expand.

.svg)

.avif)

.avif)

.avif)